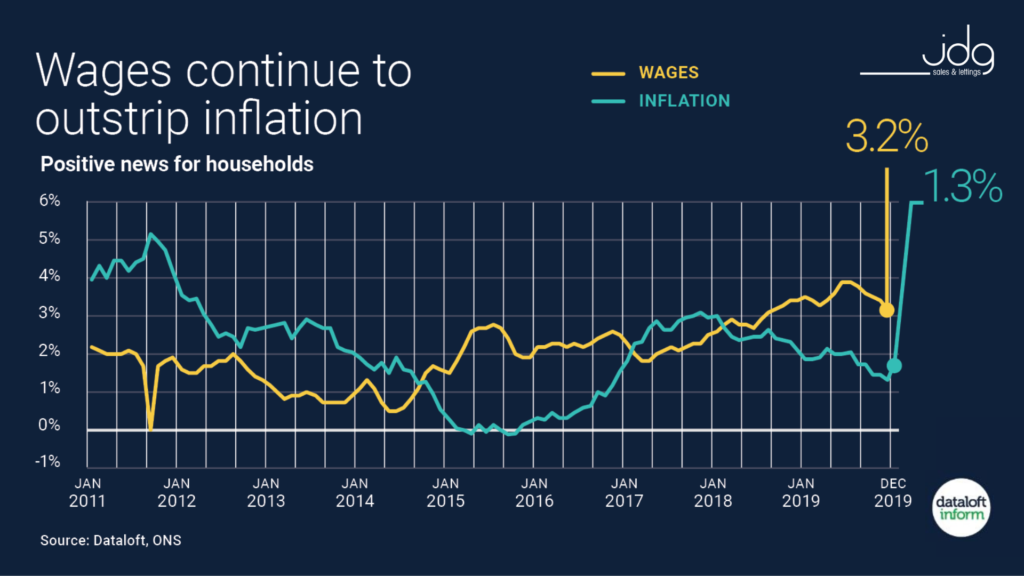

The latest data from the ONS (Office for National Statistics) brings positive news for household finances in Lancaster and the rest of the UK. The data suggests that wage growth is currently outpacing inflation, at 3.2% compared to 1.3%.

In the three months to December 2019, the UK’s average weekly pay reached £512 (excluding bonuses). This is the highest level since March 2008, before the global economic crisis.

Inflation rose to 1.8% in January 2020, mainly due to the higher cost of fuel, and the growth in house prices, among other factors. This is, however, still below the Bank of England’s 2% target and below current wage growth. The latest inflation figure mean it is likely the Bank of England interest rates will be kept at 0.75%, making mortgages more affordable.

This could also be welcome news for Lancaster landlords, since potential tenants will have relatively higher wages, and be more likely to pass affordability tests for properties with higher rents. As rents have risen due to the recent tenant fee ban, this is beneficial for both tenants and landlords.

If you would like to discuss this, or any issues relating to the local property market, feel free to call into our office on Market Street any time.