As an estate agent in Lancaster, I find it essential to provide a clear perspective on the local and national property markets, countering media myths. Despite ongoing predictions of a housing market crash since September 2022, both the British and Lancaster property markets remain stable.

National Homes for Sale

To assess market health, we first look at new property listings. In Q2 2024 (April, May & June), 450,486 properties were listed for sale across the UK, higher than the 411,927 listed in Q2 2023 and the seven-year Q2 average (2017-2023) of 399,581. The average price for a new listing in Q2 2024 was £454,223, up from £438,551 in Q2 2023.

Monitoring new listings helps understand market stability. For example, during the 2008 financial crisis, an oversupply of new listings led to price drops. By tracking the ratio of properties for sale to those sold subject to contract (SSTC) on platforms like Zoopla or Rightmove, we can gauge market trends. An increasing ratio indicates market strength, while a declining ratio suggests a slowdown, considering seasonal factors.

National Sales and Price Bands

In Q2 2024, 308,969 properties were sold SSTC in the UK, significantly higher than the 269,989 sold in Q2 2023 and above the seven-year Q2 average of £299,324. The average sale price in Q2 2024 was £369,373, slightly up from £367,030 in Q2 2023.

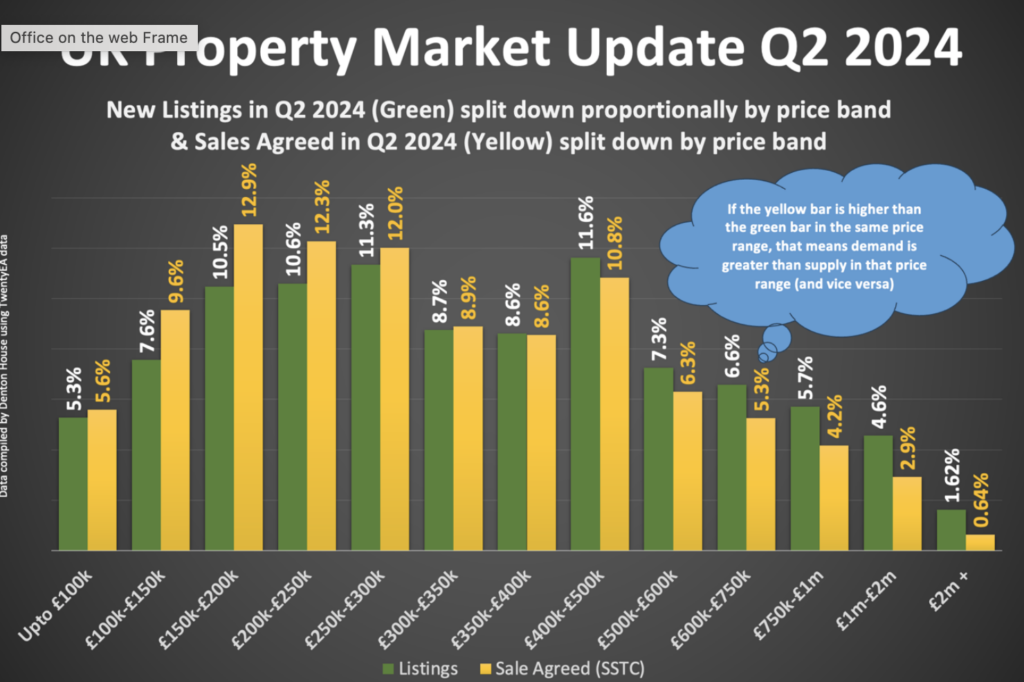

Analyzing sales by price band reveals market dynamics:

- Up to £250,000: 33.9% of listings, 40.4% of sales

- £250,000 to £500,000: 40.3% of listings and sales the same

- £500,000 to £750,000: 13.8% of listings, 11.6% of sales

- £750,000 to £1m: 5.7% of listings, 4.2% of sales

- £1m+: 6.2% of listings, 3.6% of sales

This data shows stronger performance in lower-priced properties, driven by affordability.

Market Dynamics and Pricing Strategies

Realistic pricing from the outset is crucial. In Q2 2024, 225,745 price reductions were noted on the 673,973 properties for sale, highlighting the need for competitive initial pricing. The average number of properties for sale increased by 11.3% from Q2 2023 to 2024, indicating a more competitive market.

Despite higher mortgage rates and economic uncertainties, the Lancaster property market has surpassed pre-pandemic activity levels. However, sellers should price competitively to attract buyers amid the increased supply.

Lancaster Property Market Specifics

In Lancaster (covering LA1 and LA2 postcodes), 550 properties were listed in Q2 2024 with an average asking price of £285,586. The most active price range for new listings was £150,000 to £200,000, with 99 properties listed.

Sales in Lancaster during Q2 2024 totaled 366 properties, with an average sale price of £295,755. The most active price range for sales was also £150,000 to £200,000, with 81 home sales agreed.

First-time buyer properties are leading the recovery in Lancaster, mirroring the national trend where lower-priced homes are more popular.

Conclusion

Decisions about moving home should be based on personal circumstances rather than solely on market conditions. If you are contemplating selling or buying in Lancaster, we offer no-obligation consultations to provide honest, tailored advice.

If you would like to chat through your moving plans, at JDG we are here to help. My name is Michelle Gallagher. You can email me at michelle@jdg.co.uk or call me on 01524 843322

Thanks for reading

Michelle