Since 2020, the UK property market has experienced significant shifts, driven first by the post-lockdown property boom and then by a rapid series of interest rate hikes aimed at controlling inflation in 2022 and 2023. Many experts predicted that these challenges would cause a property market crash, but this has not happened. In fact, the property market has remained surprisingly resilient.

The Impact of Rising Interest Rates

In November 2021, the Bank of England began raising interest rates to tackle rising inflation, with 14 increases in total by mid-2023, peaking at 5.25%. These measures were intended to ease the pressures caused by rising living costs, which were worsened by global events like Russia’s invasion of Ukraine in early 2022.

However, by August 2024, the Bank of England made a small cut to interest rates, bringing them down to 5%. This move, alongside improving inflation rates, has given the market a sense of cautious optimism. Although challenges remain, this rate cut offers a glimmer of hope for both buyers and sellers.

Lancaster Property Prices: A Steady Climb

Looking at house prices in Lancaster, the market has remained strong over the past four years. In July 2020, the average property value was £158,857. By July 2024, this had risen to £215,225—an increase of over 35%. Despite predictions of a market drop due to high interest rates and the pandemic, house prices in Lancaster have stayed robust.

The Role of Cash Buyers

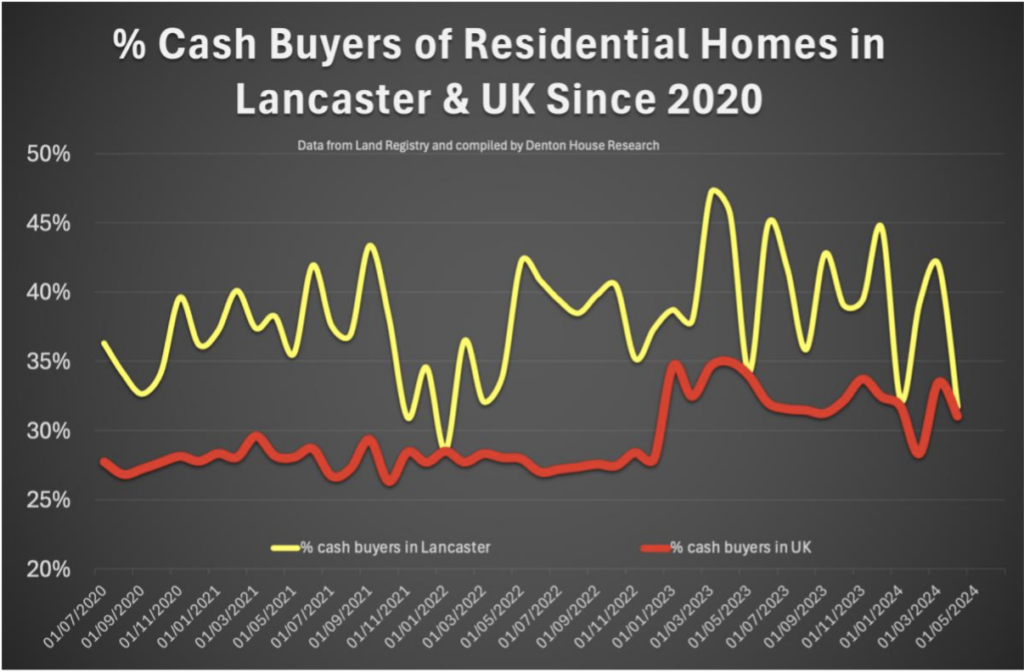

One might assume that cash buyers have been a major force behind the property market’s stability, given that they are not affected by rising mortgage rates. While the proportion of cash buyers has increased in the UK, rising from the late 20% range in 2020 to the early 30% range by 2024, this hasn’t been the game-changer many expected.

In Lancaster, cash buyers played a more noticeable role than in other parts of the UK, but still not enough to significantly alter the market. In 2020, 35.5% of buyers in Lancaster were cash buyers, compared to just 27.57% nationwide. By 2023, that figure had risen to 41% locally. However, this gradual increase did not drastically change the market, which continued to be influenced by mortgage buyers.

Why Didn’t the Market Crash?

With such sharp increases in mortgage rates, why didn’t the property market crash? The answer lies in the strict stress-testing rules introduced in 2014, following the 2008 financial crisis. These rules were designed to ensure that borrowers could still afford their mortgages even if rates went up. Thanks to these measures, most buyers were able to keep up with higher payments, and widespread repossessions were avoided.

In the four years following the 2008 crash, over 113,000 homes were repossessed in the UK. By contrast, during the pandemic years (2020-2023), just over 7,000 homes were repossessed. This shows that the market, although tested, has remained stable in the face of challenges.

Affordability and Changing Buyer Preferences

Affordability remains a key concern for many buyers, especially in more expensive areas like London. As property prices and the cost of living have risen, some buyers have been forced to look for more affordable homes outside of major cities. This trend, which accelerated during the pandemic, has continued, with many buyers seeking homes in suburban or rural areas where they can get more space for their money.

Sales Volumes and Market Resilience

While house prices have remained stable, the number of property sales has fluctuated. In 2021, sales reached a peak of 1.4 million, but this dropped to around 1.02 million in 2023. Despite this, these numbers still align with long-term trends, showing that the property market has not collapsed but instead adjusted to new conditions.

Projections for 2024 suggest that sales will climb back to around 1.15 million, further highlighting the market’s resilience.

The Lancaster Market Moving Forward

As we head into the latter half of 2024, the Lancaster property market continues to show encouraging signs of recovery. The recent interest rate cut, combined with rising sales and stable prices, suggests that the market could be on the path to further stability. For Lancaster homeowners looking to sell, this is an important time to price properties realistically and present them well to ensure a successful sale.

In conclusion, the Lancaster property market has shown remarkable strength over the past four years, despite economic pressures. As the market adapts to changing conditions, both buyers and sellers should approach with optimism, informed by the lessons of the past few years.

For more information or advice about the Lancaster property market, don’t hesitate to get in touch. We’re here to help.

Thanks for reading

Michelle x