The consensus among economists and the wider public is clear: the remarkable ascent of Lancaster’s property prices over the previous twelve years has reached its peak and is now starting to drift downwards.

Major national publications splash headlines filled with pessimism about the UK housing market, citing issues such as buyer affordability caused by challenges with average salary growth not keeping up with inflation, higher interest rates also hitting buyer affordability, and the hangover of the pandemic making recruiting people hard work. However, these gloomy projections don’t seem to resonate with the fact that Lancaster’s property market activity in the past year closely mirrors that of 2017/18/19.

This divergence might hint at the age-old notion: ‘bad news sells newspapers’.

To provide a clearer picture, let’s delve deeper into Lancaster’s property market nuances, focusing on the demographics of movers and their motivations.

During the past year, most of the property sales in Lancaster were terraced properties, selling for an average price of £172,020. Semi-detached properties sold for an average of £225,170, with flats fetching £132,860.

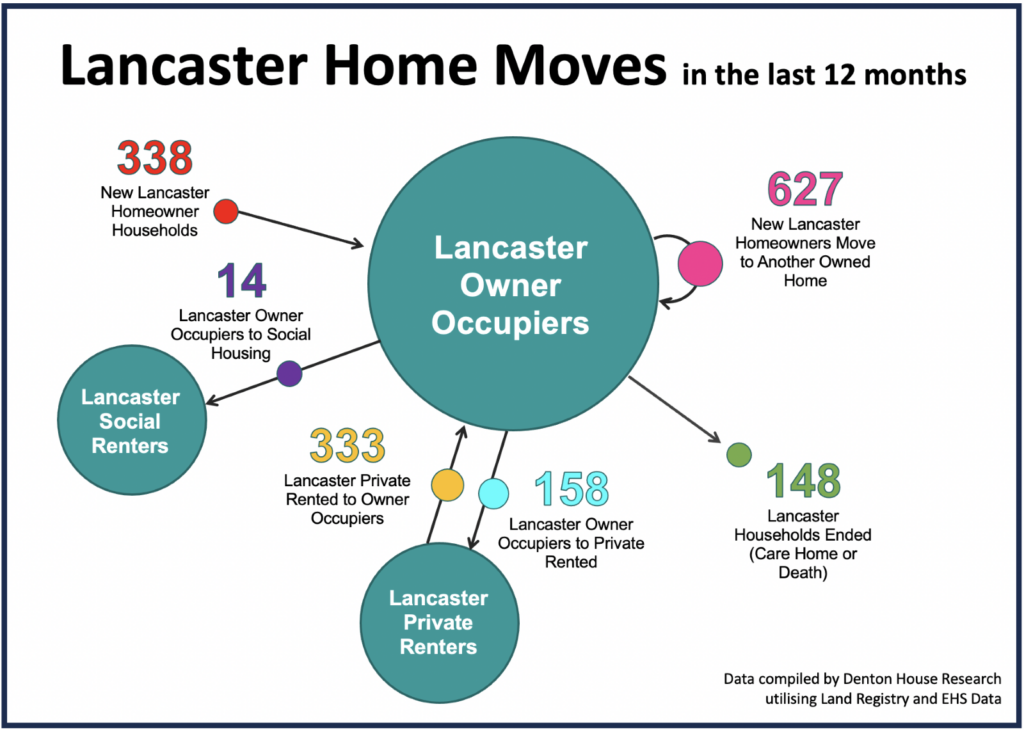

A closer look at Lancaster’s homeowner sector in the last 12 months of housing data reveals the following…

- 627 Lancaster households moved within the same ownership sector, implying they sold their home to purchase another.

- 148 Lancaster households ended and exited home ownership (i.e., moved in with family, moved to a care home or sadly passed away).

- 158 Lancaster households shifted from owning to private renting.

- 14 Lancaster households moved from home ownership to social housing (i.e., Council Housing or Housing Association).

- 333 Lancaster households shifted from private renting to homeownership.

- 338 new Lancaster homeowner households emerged, transitioning from residing with family or friends to buying their first property without experiencing the private rental sector.

Despite the relentless doom and gloom portrayed in the media about the property market, it’s heartening to witness a robust influx of Lancaster first-time buyers securing their own homes.

Remarkably, 338 of these newcomers have moved from family or friends into homeownership, showcasing the enduring spirit of people wanting to buy their home. Additionally, 333 households have transitioned from the private rented sector, demonstrating a genuine aspiration among tenants to achieve homeownership.

This trend underscores the resilience and adaptability of aspiring homeowners amidst challenging times.

But what does this data spell out for Lancaster’s buy-to-let landlords?

On the surface, with 333 households moving from private rentals to homeownership and 158 moving the other way, there seems to be a slight contraction in the private sector.

Yet, what I don’t mention is the number of new rental households. I do not have the Lancaster statistics for those yet, but we can look at the national statistics.

Whilst the number of British landlords, according to capital gains tax receipts, selling up has increased by around 45% in the last year compared to pre-pandemic levels, the number of landlords buying buy-to-let is only 19% down.

There are new rental properties being created, and whilst at lower than in previous years, it is still growing nationally by 177,000 households a year. Positive news for tenants!

I find the housing market a fascinating subject. If you would like to chat about this or indeed anything property-related, please get in touch. At JDG we are here to help!

Thanks for reading

Michelle