Today we want to talk about mortgages. Mortgage approvals are a good indication of housing demand. It helps indicates people intentions both in the current and future housing market.

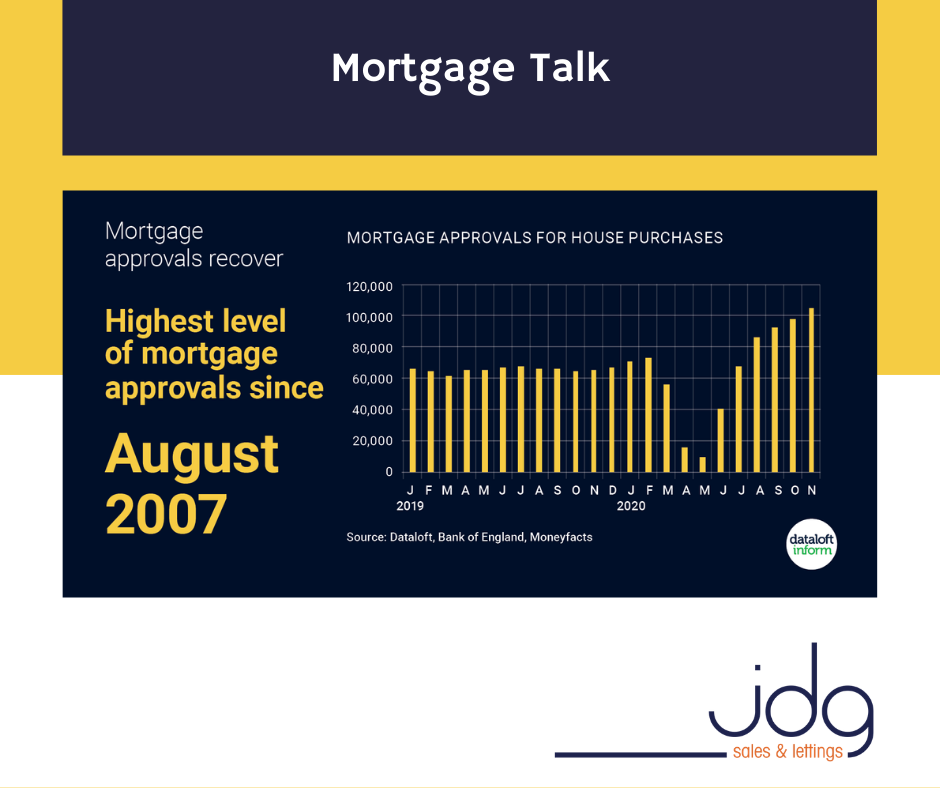

The graph above shows the level of mortgage approvals both post the pandemic starting upto November 2020, and now. This is the latest data to be reported. As you can see there has been a steady growth and in November 2020, it reached the highest level of new approvals since August 2007.

What is interesting is that despite April and May having minimial activity, mortgage approvals were only down -0.9% (January to November 2020) compared to the same period in 2019.

104,969 mortgages were approved in November 2020, the highest level since pre-Global Financial Crisis. Lenders expanding the number of mortgages available to first-time buyers helped boost recent figures.

There are currently 160 deals available for buyers with a 10% deposit, up from a low of 51 in October 2020. However, this is still significantly lower than the 762 deals that were available in January 2020.

The remarkable recovery of mortgage approvals has been thanks to households re-evaluating their housing requirements and fuelled by the stamp duty holiday.

If you are thinking of buying or selling in Lancaster or Morecambe, please get in touch. At JDG we are to help.

Call us on 01524 843322 or email me at michelle@jdg.co.uk

Source: Dataloft, Bank of England, Moneyfacts